This is a sponsored post for SheSpeaks/Prudential. All opinions are my own.

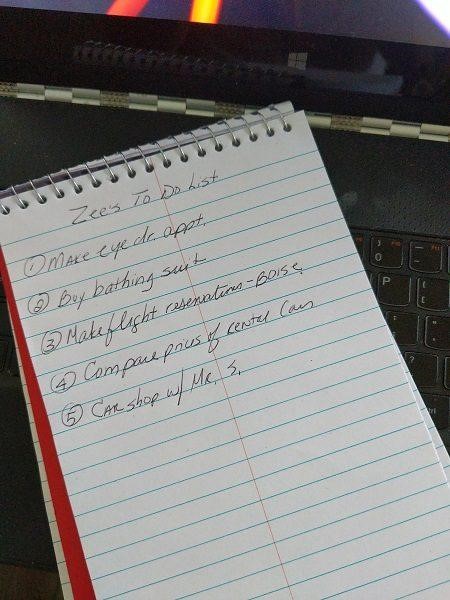

I am a fly by the seat of my pants secret planner

I am fly-by-the-seat-of-my-pants with an underlying planning gene type

I know, I am an anomaly having both. On one hand, I have a habit of throwing caution to the wind and taking off, doing something exciting and not looking back….but I’ve got a list of what to do in my hand JUST IN CASE. Sometimes it all works out, other times it doesn’t.

Hey look, I’m on a poster!

Like that time

If you had come to the Spark Your Retirement event in Fort Lauderdale you would have heard my story. In a nutshell, I was forced into retirement at the age of 44 after an accident. Was I prepared? Absolutely NOT. It really didn’t hit me for a while that I’d be without an income once all was said and done.

I thought I had it all figured out…

That made me stop and take a look

….and that’s when I…

- Started blogging

- Moved to Florida

- Paid off my debts

- Bought a house

- Began investing for my retirement

But, I know that it still wouldn’t be enough if I did it the way that I had been taught. I want to know that I’ll have enough money to live on, pay my medical bills, travel, and go out with my friends, well into my 70’s, 80’s and (fingers crossed) 90’s. I’m planning to live a L-O-N-G time and to keep having FUN. Butwhen I looked at what I’d saved and invested, I know it’s not going to be enough. At this pace, I’m afraid that I will outlive my money.

Like most women my age

I didn’t work as long as my husband did, which means that I don’t have the same retirement plan that so many men do. I took time off to raise our family AND had that accident which cut my earnings short. That means less Social Security and less retirement savings.

I learned a LOT in that short time

Getting my ducks in a row

- I went to the Social Security site to see how much I’d get….it is 3-figures a month. Well, that’s depressing.

- I took a look at my investments – they are in bonds and mutual funds. UGH, what if the market crashes?

- I thought about having to live with Ben & Allyson for the rest of my life and DON’T want to have to do that to them

- I decided to make an appointment to learn how to protect my lifetime income

I’m grateful that I had the opportunity to speak at the Prudential event

Because I learned SO MUCH from it. Yes, I was there to tell my story, but what I learned about securing my future and how I can protect my lifetime income was the most valuable part of the night for me. I learned about the unique challenges we have as women when it comes to retirement income planning. This is NOT something that I want to leave up to my husband (who frankly can outspend me 3 to 1 on any given day).

- Offer a predictable annual income stream as long as you live

- Provide income growth for those taking income later

I want a check EVERY month.

I really want to set-up an income for the rest of my life.

I’ll be asking my Prudential financial professional what portion of my retirement plan should be invested in an annuity so that I’ll have a protected income for the rest of my life. She has the knowledge and solutions to help me fill a critical gap in my retirement planning by supplementing savings, social security, and investments, and can help me create a strategy that I need. After learning from Prudential financial professionals about annuities, I’m very excited about adding them to my retirement plan.

What is an Annuity?

An annuity is a long-term investment made with an insurance company, designed to provide income in retirement. The insurance company will provide you with income payments over a specific period of time, often for life, in exchange for a fee that allows them to protect that income.

That type of plan would ensure that I’d get a “PAYCHECK” every month. I’d know what I’d be getting (bundling my social security, my investments, and an annuity) and be able to enjoy my golden years instead of worrying about them.

Have you thought about your retirement yet?

It’s not too late (and it’s NEVER too early). Join me and make a complimentary appointment with Prudential Professional TODAY at smarturl.it/FtLForm

What are you waiting for?