This post has been sponsored by Anthem, Inc. All opinions are strictly my own.

My double-shot Monday papers

My birthday is this coming Monday (save your birthday wishes, I’m trying to ignore the fact that I’m that old). I am old enough to get Social Security, but young enough to hang out with my 30 year old friends, go out on the town (I just don’t bounce back as quickly), and travel solo around the world. That being said, I realize that I am at an age that I have to be more careful with both my health and my money. This week I took care of myself getting both a flu shot and my first of two shingles vaccines. I was feeling pretty good until I realized that I had to pay the $150 cash price for my shingles shot. UGH! But, I know that it’s better to take care of myself now and stay as healthy as I can.

Planning Ahead

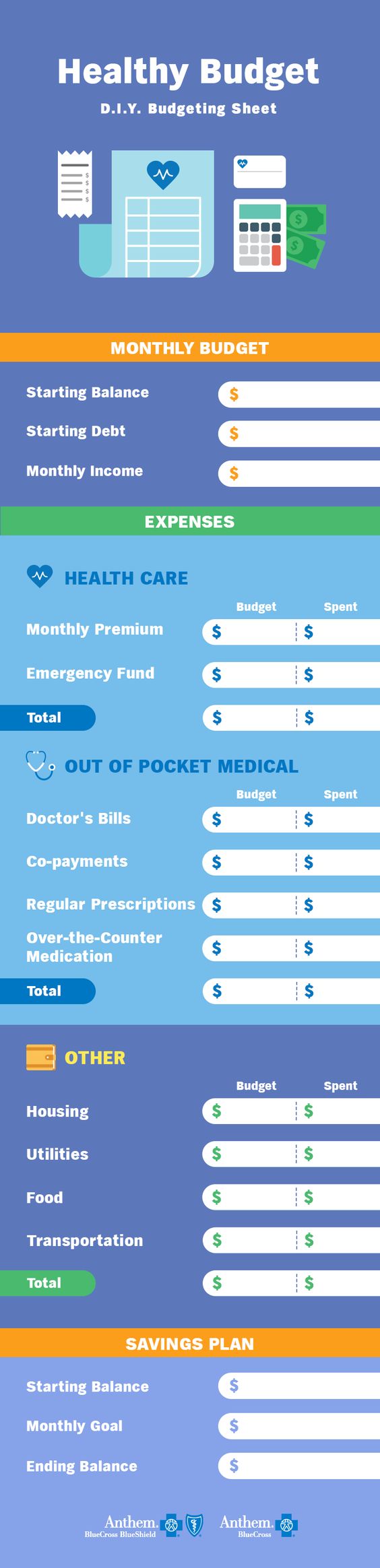

Getting my necessary vaccines is just one piece of my healthy plan. I also try to exercise regularly and make good food choices. I know that planning ahead is the best way to tackle getting older, and that includes planning for my medical expenses. After my “double-shot Monday” I needed to find a way to take control of more than just keeping myself on track with preventative health care and making appointments for my regular check-ups. I needed to have a “healthy budget” as well. That’s when I found Anthem, Inc. and its affiliated health plans “Healthy Budget” cost calculator to help me manage the costs of healthcare for Mr. S and I.

Knowing in advance takes the sting out

I budget for groceries, I know what I spend on the mortgage and utilities, and I even have a travel fund. Now I’ve also got a budget to keep track of my health needs. Thanks to Anthem’s affiliated health plans, I learned a lot about how to know exactly where I need to spend and cut back, because you know that I always want to have enough and be healthy enough for my next adventure.

Isn’t it time you had a healthy budget?

- For help with saving on your Medicare Health Needs visit Anthem’s affiliated health plans

- Print up the “Healthy Budget” cost calculator above to help budget for your medical needs.