Note: This post was sponsored by Regions Bank. All opinions are my own. I learned LOADS about how to take the financial stress out of the holidays from them & I’m sharing it with you here.

I’ve got less than ONE WEEK to get it all done.

The shopping, the decorating, the wrapping, the cooking. Chanukah is here EARLY this year (December 6-14).

- Eight Days of lighting the menorah

- Eight Days of latkes and sufganiyot (donuts)

- Eight Days of spinning the dreidel

- Eight Days of celebrating

- Eight Days of gifts

As a child I looked forward to having over a week of celebration, as an adult…NOT SO MUCH. As our family grew, so did the expenses of the holidays. The spending can EASILY get out of hand (especially if you love to shop like I do). Luckily, I have the shopping portion under control, as most of the gifts are purchased (I’ll tell you my secret later in this post).

This year the predictions are that we’ll spend even MORE money than last on the holidays with the average American set to spend an estimated $786 on gifts for family, friends, colleagues and others.

That’s a LOT of money!

Before subjecting my credit card to holiday expenses, I turned to Regions Bank for some advice. They have laid out the do’s and don’ts of holiday spending, with insights on How to Save Money for the Holidays

Their BEST tips

Remember the golden rule.

Begin with the golden rule. Keep your spending at or below 1.5 percent of your annual income. Use this to set aside your budget on spending for everyone that you give gifts to. STICK WITH IT!

Put money aside for gifts

By creating a separate account for gift buying, you can put money aside throughout the year. Whether it be weekly, bi-weekly or monthly, you’ll have the money for the holidays without having to break your budget.

Buy what you can afford.

Remember the old adage, it’s the thought that counts? It’s still true. They won’t love you any less if you purchase within your means. Have a list and make sure that you have the money to purchase your gifts when shopping. That way you won’t be faced with unexpected bills come January.

Time your shopping

Keeping track of sales and price drops can save.

Example: airline tickets should be booked far in advance, while other items, like toys in particular go on sale the beginning of December. It’s worth going online or checking the sale circulars in the newspaper before you head out, as sometimes it pays to wait, other times it doesn’t.

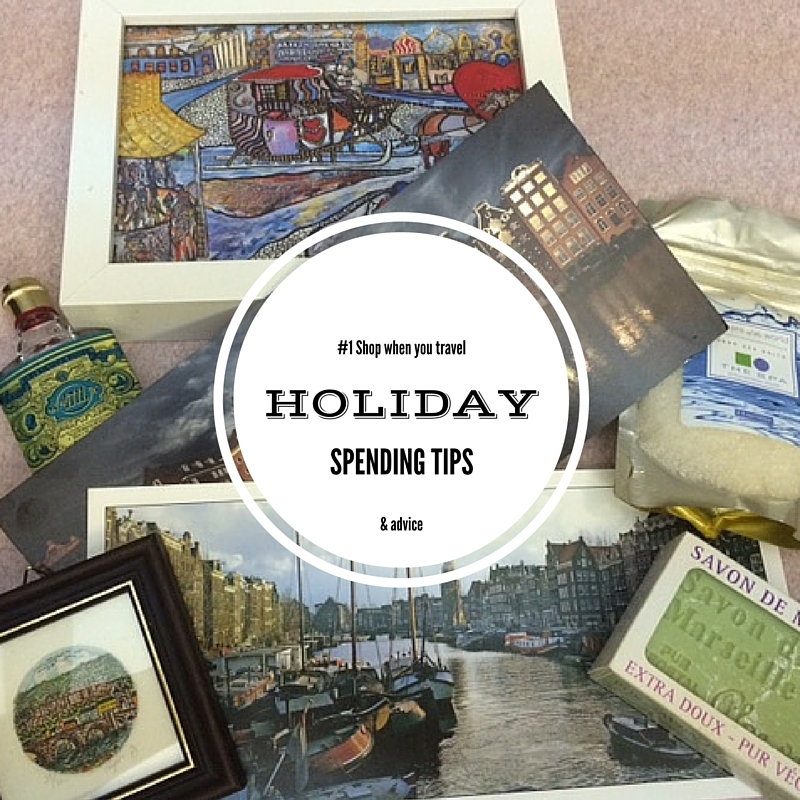

How I save on gifting

I’m not a BIG DIY’er, so you may not see me with glue gun in hand (if you are you can save a BUNDLE). I purchase all year long as I travel, and put it away for the holidays. I’ll pick up little things (usually under $5) and put them together in themed gift bags or baskets. Like the beautiful soaps I purchased in Marseille last year (they were 3 for $5) or the greeting cards and postcards that are artist reproductions of the cities I visited (I’ll head to Ikea for inexpensive frames for them and my friends get beautiful artwork from all over the world).

Need a little help?

- Regions Bank has the BEST advice about How to Save Money for the Holidays